How OneFund Works

Why are we doing this?

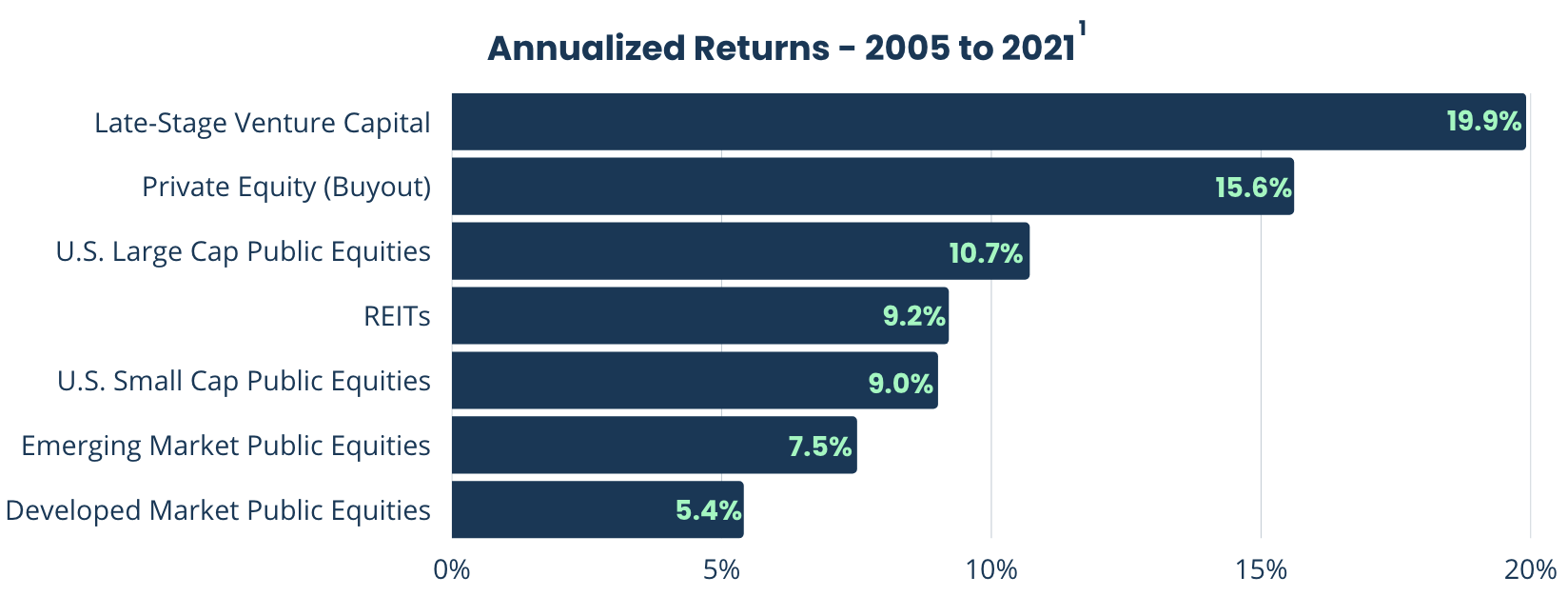

Historically, certain institutions and individuals have had access to investment opportunities that most people simply cannot access. Private Equity has historically outperformed public markets1 yet for decades these investments have been out of reach for most investors. At OneFund, we are changing this, by offering more institutions and individuals the ability to invest in vetted private equity funds.

How are we doing this?

We give our members access to top-tier private equity funds, allowing them to benefit from their potential returns. OneFund pools money from our investors and then invests into various private equity funds. When the funds return money to OneFund, we return that money to our investors, additionally handling tax documents and reporting so you can stay up-to-date on the status of your investment.

How does OneFund decide what opportunities go on the platform?

Our philosophy is to give our members the access and information that they need to make private market investments and we encourage all our members to do their own research. That being said, we only allow vetted private equity funds on the OneFund platform. Period.2

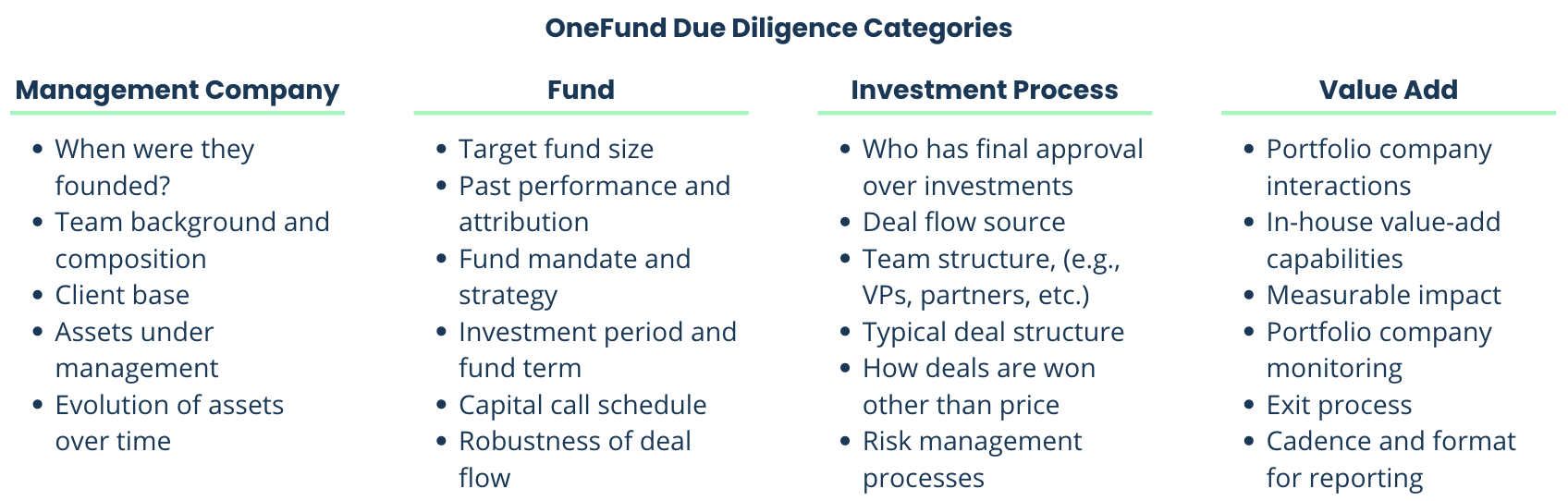

When we due diligence funds, we look at four main areas to verify that we want to make them available to our members.

How do fees work?

We charge a percentage fee on assets under management (i.e., the value of your investment) varying from 1.25% to 0.50% depending on the size of an investment.

We also charge 5% carried interest over an 8% hurdle. What does that mean? If your investment's net returns are over 8% per year, we take a small cut of the returns over 8%. If your investment's net returns are under 8% per year, we do not charge this fee.

Why is carried interest good for you? Our interests are 100% aligned with getting YOU returns on your investment because if your investment does not make over 8%, we charge you no carried interest fee.

It is important to know that the private equity funds that OneFund invests in also charge OneFund fees. Our members do not need to separately pay these fees, they are covered by your initial investment. Private equity funds typically charge OneFund roughly 2% on committed capital and 20% carried interest. These are standard fees across the private equity industry.

What are capital calls and how do they work?

When you invest in a Private Equity fund, those funds search for private companies to buy. When a fund decides to buy a company, they issue a "capital call" to their investors. Once a capital call is issued, investors send their money to the fund to purchase the private company. OneFund is responsible for meeting these capital calls.

What does this mean for you? All investors must wire a certain amount of their allocation to OneFund when they make their investment. Depending on the size of one's investment and the particular offer invested in, you may only be required to wire a portion of the money in year one with an option to wire the remainder following years.

Important Note: Capital calls may be accelerated as needed to satisfy commitments to the underlying fund. You can read more about this here.

Questions about liquidity?

You should only invest money in OneFund that you will not need for the full duration of the investment. Investments in Private Equity are highly illiquid and typically cannot be easily bought and sold like public stock. We may offer liquidity opportunities to members in the future through methods such as secondary trading, for example. However, this functionality is not available and should not be relied upon as a certain means for liquidity.3

Who manages my money when I invest?

When you invest, your money goes to one of our funds which then invests in to various Private Equity funds. Our funds are separate legal entities which OneFund Investments, LLC advises.

2 Investing in private equity and venture capital funds involves a high degree of risk, including a complete loss of investment. Past performance is no guarantee of future results, and any expected returns or hypothetical projections may not reflect actual future performance. Prior to making any investment decisions, you should (i) conduct your own investigation and analysis, (ii) carefully consider an investment’s risk factors, investment objectives and strategy, fees and expenses, and any tax consequences that may result from investing, and (iii) consult with your own investment, tax, financial, accounting, and legal advisors.

3 This material is for informational purposes only and is not an offer to sell or solicitation of an offer to buy any securities, or participate in any investment, in any jurisdiction where such an offer or solicitation would be unlawful. This material should not be construed as, and is not intended to provide, investment, tax, financial, accounting, legal, regulatory or compliance advice of any kind, and should not be relied upon in connection with any investment decision.