This page is for the explicit use of the recipient and not for sharing.

About Cerberus: Cerberus Capital Management is a global private investment firm founded in 1992 with a focus on private equity and distressed assets. The firm has $64B in assets under management across a diverse portfolio including industrials, healthcare, finance, real estate, and more.1 Cerberus is known for its hands-on approach, helping its portfolio companies to grow. Learn more about Cerberus at www.cerberus.com.

We are particularly excited about Cerberus' Supply Chain Fund because of the firm's 30+ year track record, very favorable terms to investors (1.5% management fee, 15% preference)2, and the fund's unique thesis.

Investing in similar funds directly could carry a minimum investment of $25M or more. However, when investing via OneFund, the minimum is only $50,000.

Cerberus overview and select fund terms5

Important risk warning: Past performance is not indicative of future results. Target returns are hypothetical and incorporate significant estimates and assumptions that may or may not prove to be correct. Nothing in this offering, including but not limited to the Targets, is intended to operate, nor any aspect of this offering may be relied upon, as any sort of promise, guarantee, undertaking, or representation as to the future performance or results of the potential investments. The Targets contained in this Offering are based on assumptions that Cerberus believes to be reasonable in light of the information presently available.

Cerberus Supply Chain Fund Overview11

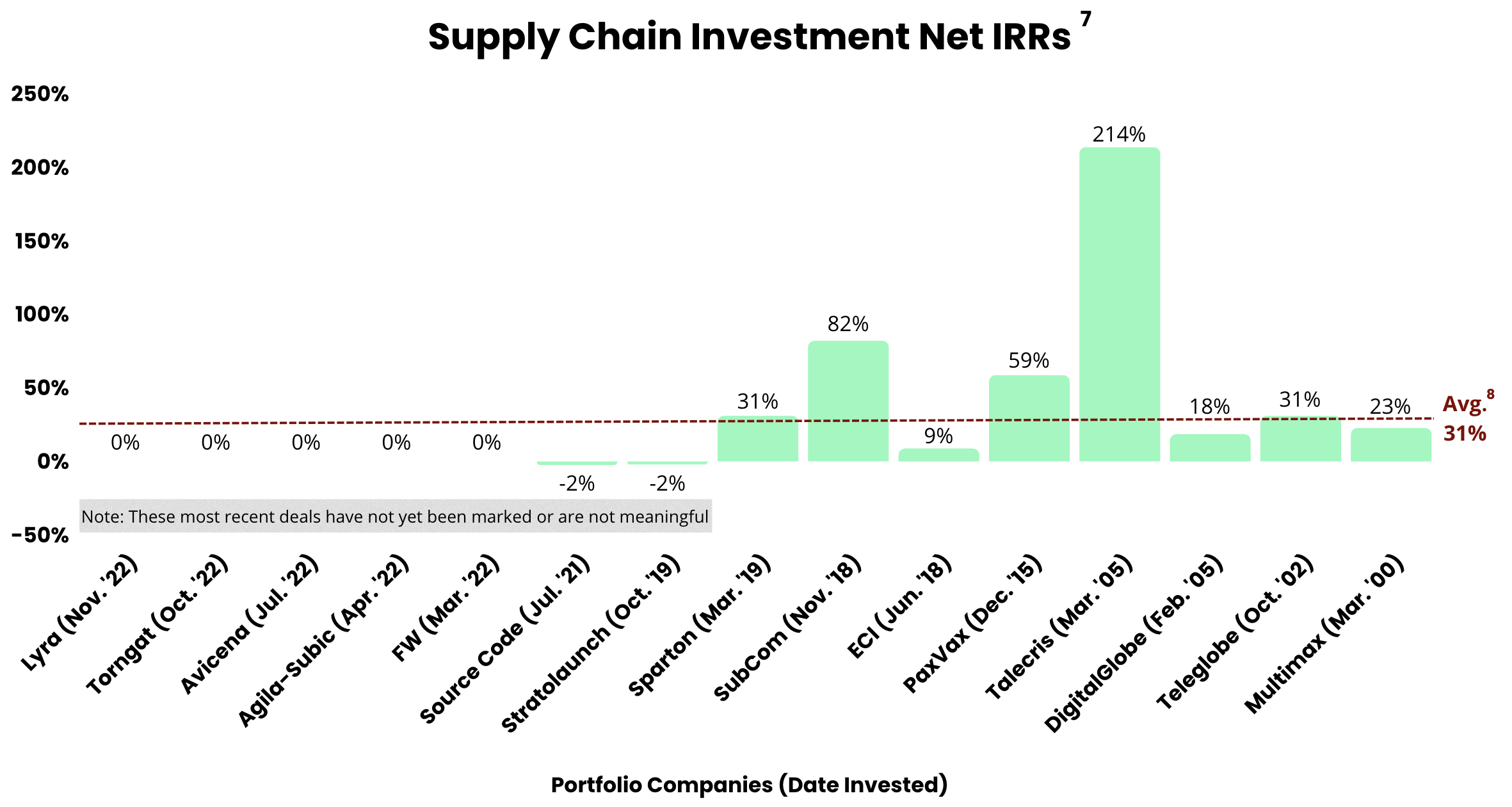

Track Record

Important risk warning: Past performance is not indicative of future results. Target returns are hypothetical and incorporate significant estimates and assumptions that may or may not prove to be correct. Nothing in this offering, including but not limited to the Targets, is intended to operate, nor any aspect of this offering may be relied upon, as any sort of promise, guarantee, undertaking, or representation as to the future performance or results of the potential investments. The Targets contained in this Offering are based on assumptions that Cerberus believes to be reasonable in light of the information presently available.

What we like about Cerberus Supply Chain Fund

30+ years of experience investing in alternative investments

Leadership team has strong, relevant experience including a former Chairman of the President's Intelligence Advisory Board, Vice President of the United States, Sec. of the Treasury, Administrator of NASA, acting CIA Director, Verizon CIO, Head of Silicon for Google Infrastructure, and more. Check out more details on the team here

The fund has favorable terms for investors, charging a 1.5% management fee compared to the 2% to 3% industry standard. Additionally, carried interest is charged only after a 15% preference compared to the industry norm of no preference9

Supply chain-oriented companies exhibit durable earnings due to strong customer relationships and the critical nature of the services and products that they provide

Deep experience operating and investing in supply chain-oriented companies such as Teleglobe, Multimax, and SubCom. You can read more about Cerberus's supply chain thesis here

Market Cautions

While Cerberus has been making supply chain-oriented investments for decades, this is their first supply chain focused fund

Supply chain specific investments are subject to certain risks such as currency fluctuations and the actions of nation-states such as tariffs, treaties, etc. Check the offering documents for a fuller set of risks

While Cerberus is targeting investments across industries (e.g., healthcare, IT, shipping, etc.), the investments are fundamentally focused on supply chain and thus carry certain industry-specific risks such as currency fluctuations, operational risks, trade risks, etc.

Documents

Supply Chain Investment Track Record

Private Placement Memorandum (PPM) (updated 08/09/23)

Limited Partnership Agreement (LPA) (updated 08/09/23)

Terms

OneFund Vehicle

General Partner: O/F Fund I GP, LLC

Investment Advisor: OneFund Investments, LLC

Fund Name: O/F Private Equity Opportunity I, LP

OneFund Fees

Initial Setup fee: $0

Assets Under Management (AUM) fee:

Carried interest: 5% over an 8% IRR Hurdle

Questions about carried interest? Read below.

What does carried interest mean? If your investment returns over 8% per year, we take a small cut of the returns over 8%. If your investment returns under 8% per year, we do not charge this fee.

Why is carried interest good for you? Our interests are aligned with getting YOU returns on your investment because if your investment does not net over 8%, we charge you no carried interest fee. Some companies that don't charge carried interest charge higher base fees to make up for this, which you pay whether or not your investment performs.

Capital calls

What are capital calls? Capital calls dictate when a commitment needs to be transferred to OneFund in order to fund the investment. For larger commitments, capital calls can be spread over multiple years. For smaller investments, we require the capital upfront.

Note: Capital calls may be accelerated as needed to satisfy commitments to the underlying fund. You can read more about this here.

Underlying Cerberus Supply Chain Fund Terms

Fund Name: Cerberus Supply Chain Fund, L.P.

Fees: Cerberus charges OneFund fees to be an investor in their fund. You do not need to pay these fees as they are covered by your commitment made through OneFund. The fees Cerberus charges OneFund are a 1.5% management fee and 20% carried interest after a 15% Net IRR Preference.10

Risks and Disclosures

These materials have been prepared by OneFund Investments, LLC (“OneFund”) for select recipients for informational purposes only. These materials are not intended for publication or distribution.

By accepting these materials, the recipient agrees that he or she will, and will cause their representatives and advisors to, use the information contained herein for informational purposes only. The recipient also agrees to maintain such information and any information made available in connection herewith in strict confidence in accordance with the terms of the OneFund Non-Disclosure Agreement, a copy of which can be viewed here. Neither these materials nor any information contained herein or made available in connection herewith may be copied, published, distributed, transmitted, or otherwise disclosed, wholly or in part, to any third party for any reason whatsoever without the prior written consent of OneFund.

Certain information contained in these materials have been obtained from published and non-published sources prepared by the underlying funds into which OneFund invests as well as by unrelated third parties, which in certain cases have not been updated through the date hereof. While such information is believed to be reliable for the purpose used in these materials, OneFund does not assume any responsibility for the accuracy or completeness of such information and such information has not been independently verified by OneFund. Except where otherwise indicated herein, the information provided in these materials is based on matters as they exist as of the date of preparation of these materials and not as of any future date and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof.

Statements contained in these materials that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of OneFund or the underlying funds into which OneFund invests. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed on such statements. Certain information contained in these materials constitutes “forward-looking statements.” Any forward-looking statement expressing an expectation or belief as to future events is expressed in good faith and believed to be reasonable at the time such forward-looking statement is made. However, these statements are not guarantees of future events and involve risks, uncertainties and other factors beyond OneFund’s control or the control of the funds into which OneFund invests. Therefore, actual outcomes and results may differ materially from what is expressed in any forward-looking statements.

The investments and services offered by OneFund may not be suitable for all investors (i.e., they may not be appropriate for each investor’s goals, needs, and risk tolerance). Investment in private market and alternative investment securities carries specific risks that can impact investment performance, such as, but not limited to, valuation risk, risk associated with the securities of smaller companies (such as bankruptcy), liquidity risk (as most investments will not be traded publicly it may be difficult to liquidate positions early), competitive environment risk due to the number of private equity funds competing for deals, key person risk associated with professionals at certain private equity funds, and market risk. Past performance is no guarantee of future results, and any expected returns or hypothetical projections may not reflect actual future performance. The value of an investment may go down as well as up, and an investor may lose some or all of the money that they invest Nothing in these materials, should be construed as, or is intended to be, an offer to sell or solicitation of an offer to buy any securities, or participate in any investment. If any offer of securities is made, it will be made pursuant to a definitive private placement memorandum and related offering materials (collectively, the “Offering Materials”) prepared by or on behalf of the relevant OneFund fund. Any such Offering Materials would contain material information not otherwise contained herein, which information would supersede the information in these materials. An investment decision should only be made after reviewing the Offering Materials in their entirety, conducting such investigations as the investor deems appropriate and consulting with the investor’s own investment, tax, financial, accounting and legal advisors. No communication by OneFund should be construed as, or is intended to be, investment, tax, financial, accounting, legal, regulatory or compliance advice. OneFund is not a registered investment adviser or registered broker-dealer and does not provide investment recommendations or advice of any kind.

1: Information provided by Cerberus Capital Management, LP. Information from Q3 2023 Firm Overview deck.

2: Information provided by Cerberus Capital Management, LP. Information from May 2023 Cerberus Supply Chain Fund, L.P. overview deck page 27 (see for reference). These terms are considered favorable compared to the industry standard of 2% to 3% management fee and no preference.

3: Information provided by Cerberus Capital Management, LP. Information from Q2 2023 Cerberus Supply Chain Fund, L.P. Investment Examples deck. Please note, the logo for Lyra is represented by text only and is not the official logo.

4: Information provided by Cerberus Capital Management, LP. Information from Q2 2023 Cerberus Supply Chain Fund, L.P. Investment Examples deck. These examples include both current and previous Cerberus portfolio companies, however not companies invested in by the Cerberus Supply Chain Fund, L.P. because these investments were made prior to the fund.

5: Information provided by Cerberus Capital Management, LP. Information except for AUM from May 2023 Cerberus Supply Chain Fund, L.P. overview deck. AUM figures from Q3 2023 Firm Overview deck. AUM figure as of March 31, 2023. Target IRRs represent the target IRRs of the underlying fund. Target returns are hypothetical and incorporate significant estimates and assumptions that may or may not prove to be correct. Nothing in this offering, including but not limited to the Targets, is intended to operate, nor any aspect of this offering may be relied upon, as any sort of promise, guarantee, undertaking, or representation as to the future performance or results of the potential investments. The Targets contained in this Offering are based on assumptions that Cerberus believes to be reasonable in light of the information presently available.

6: Information provided by Cerberus Capital Management, LP. Information except for AUM from May 2023 Cerberus Supply Chain Fund, L.P. overview deck page 27 (see for reference). Full details indicate state that the term is a 5 year investment period with an option to extend 1 year subject to the consent of the LPs, followed by a 6 year post investment period with an option to extend 1 year subject to the consent of the LPs. There are additional optional extensions subject to the consent of the LPs.

7: Information provided by Cerberus Capital Management, LP. Information from Q2 2023 Cerberus Supply Chain Fund, L.P. Investment Examples deck. These numbers are as of the latest date provided by Cerberus and vary across investments. Full details are available in the aforementioned material on this page under "Documents". Included current and exited investments. The most recent 7 deals have either not been marked or only slightly adjusted, full details are available in the aforementioned material on this page under "Documents".

8: Information provided by Cerberus Capital Management, LP. Information from Q2 2023 Cerberus Supply Chain Fund, L.P. Investment Examples deck. This number is a simple average of the Net IRRs from the relevant investment examples provided by Cerberus in the aforementioned material. The investment examples used in the average include both current and exited portfolio companies.

9: Information provided by Cerberus Capital Management, LP. Information from May 2023 Cerberus Supply Chain Fund, L.P. overview deck page 27 (see for reference). These terms are considered favorable compared to the industry standard of 2% to 3% management fee and no preference.

10: Information provided by Cerberus Capital Management, LP. Information from May 2023 Cerberus Supply Chain Fund, L.P. overview deck page 27 (see for reference).

11: The figures in this section represent what the underlying fund, Cerberus Supply Chain Fund, L.P., is targeting to do. There can be no assurances that this is how the fund will strictly operate.

Note: Updated as of July 27th, 2023