This page is for the explicit use of the recipient and not for sharing.

The OneFund Early Stage Venture Portfolio is a portfolio of multiple early stage venture capital funds, giving investors exposure to multiple venture capital strategies with a single investment.

Investing in similar VC funds directly could have a minimum investment of over $2M USD. However, when investing via OneFund, the minimum is only $10,000.

About the funds:

Animal Capital has developed a unique network of operating partners with 100m+ combined followers across social media channels. This reach gives Animal Capital access to high quality deal flow due, the ability to add strong value to the companies they invest in, and an advantage over other venture funds when competing for sought after deals. Animal Capital's first fund was oversubscribed by 68%. Their team has experience at Goldman Sachs, General Atlantic, AF Ventures, and more.1

Breakwater Ventures (formerly SeaChange Fund) focuses on investing in startups on the Pacific Northwest. Breakwater has conviction in the PNW startup ecosystem given the persistent regional funding gap, attractive entry points, and their close relationships with local academic institutions. Breakwater, through SeaChange Funds I - VII (it's historical funds), has a long track record and is currently raising its 8th fund.3

Gutter Capital focuses on investing in software-driven companies that are solving mission-critical issues in fields such as energy, AI, and workforce enablement. They invest at the seed and pre-seed stage and the team has experience investing in 100+ companies with top-quartile results.11

VoLo Earth Ventures invests in companies with quantifiable carbon and environmental impact through a profit first approach. VoLo Earth is raising their second fund after raising a successful first fund that included several investments which increased more than 2x in under 2 years.10

Interested in this offering? Schedule a call with our founders to discuss

Highlights across funds7

Important risk warning: Past performance is not indicative of future results.

Fund Overview

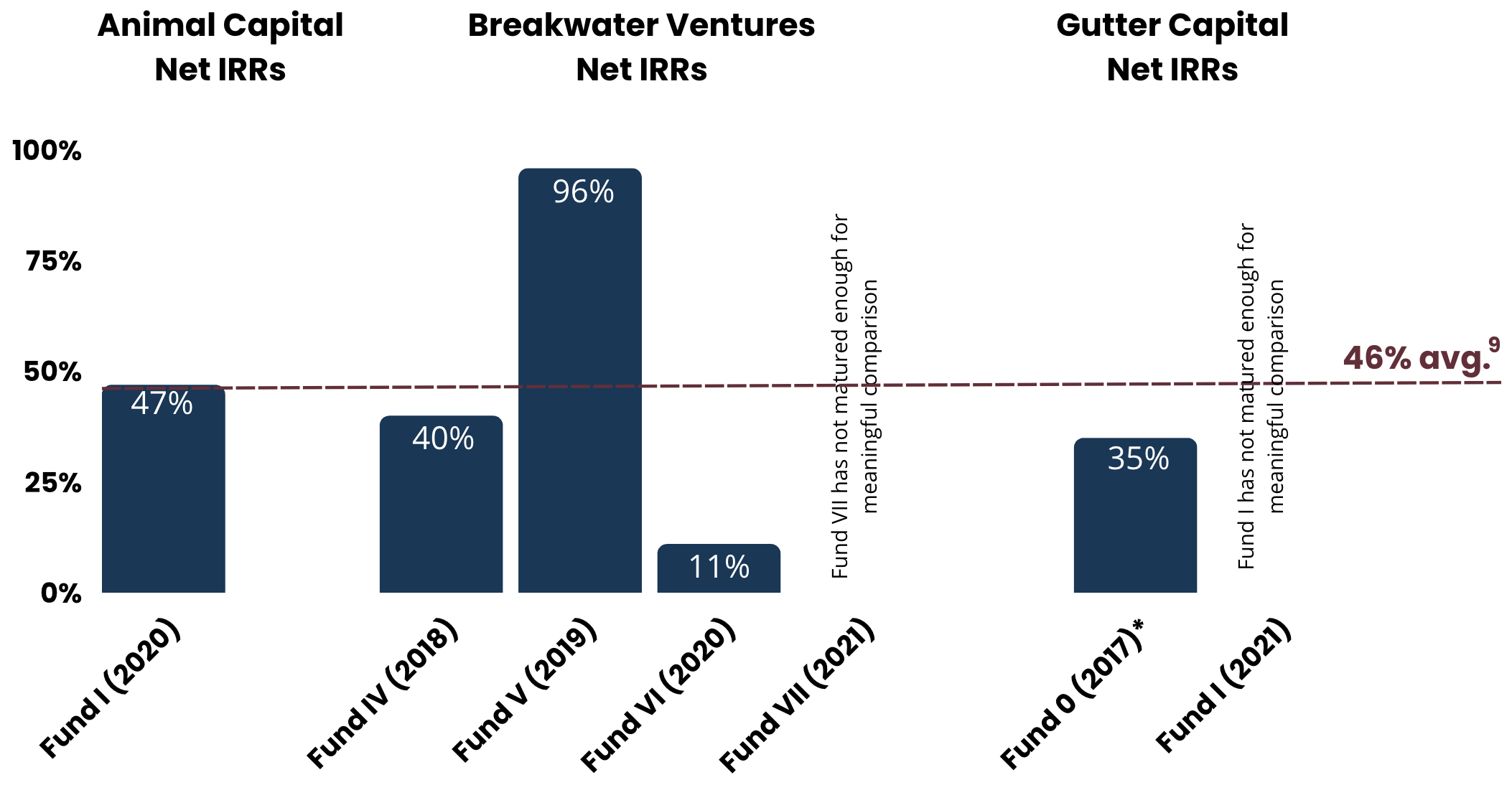

Track Record8

Important risk warning: Past performance is not indicative of future results.

*Gutter Capital Fund 0 represents the collective angel investments of the Gutter Capital General Partners as reported by Gutter Capital. For more information, please see the Gutter Capital Fund II deck in the "Potential Fund Documents" section.

Shows complete past returns of Animal Capital and Gutter Capital funds as reported to OneFund Investments by those funds. Shows Breakwater Ventures' predecessor funds run by the same management team. See Breakwater Ventures Fund I material in the "Potential Fund Documents" section for more details.

What we like about these funds

Diversified portfolio of multiple venture capital funds each with distinct theses and skillsets

Target investments will be across industries including consumer, healthcare, technology, life sciences, and more, providing diversification

Underlying target funds give access to early stage privately held investments not available via public markets or stock exchanges

Funds in the pipeline have deep experience across their respective areas including social media marketing, clean tech, vertical software, and the Pacific Northwest startup ecosystem

Potential Fund Documents

Breakwater Ventures Fund Overview

Private Placement Memorandum (PPM)

Limited Partnership Agreement (LPA)

Terms

OneFund Vehicle

General Partner: O/F Fund I GP, LLC

Investment Advisor: OneFund Investments, LLC

Fund Name: O/F Fund I (AI), LP

OneFund Fees

When it comes to fees, we have a simple philosophy. No hidden fees! Unlike some other financial products on the market, OneFund’s vehicles have no hidden administrative fees, no “one-time setup fees”, and no unforeseen expenses. Our detailed fees are below.

Initial Setup fee: $0

Assets Under Management (AUM) fee:

Carried interest: 5% over an 8% IRR Hurdle

Questions about carried interest? Read below.

What does carried interest mean? If your investment returns over 8% per year, we take a small cut of the returns over 8%. If your investment returns under 8% per year, we do not charge this fee.

Why is carried interest good for you? Our interests are 100% aligned with getting YOU returns on your investment because if your investment does not make over 8%, we charge you no carried interest fee. Some companies that don't charge carried interest charge higher base fees to make up for this, which you pay whether or not your investment performs.

Capital calls

What are capital calls? Capital calls dictate when a commitment needs to be transferred to OneFund in order to fund the investment. For larger commitments, capital calls can be spread over multiple years. For smaller investments, we require the capital upfront.

Note: Capital calls may be accelerated as needed to satisfy commitments to the underlying fund. You can read more about this here.

Underlying Venture Fund Terms

The OneFund vehicle will pay fees to the underlying funds in the portfolio which will be generally inline with typical fees charged by Venture Capital funds. You do not need to pay these fees as they are covered by your commitment made through OneFund. Standard fee structures are 2% on committed capital and 20% carried interest. Actual fees may vary depending on the funds in the portfolio.

Risks and Disclosures

These materials have been prepared by OneFund Investments, LLC (“OneFund”) for select recipients for informational purposes only. These materials are not intended for publication or distribution.

By accepting these materials, the recipient agrees that he or she will, and will cause their representatives and advisors to, use the information contained herein for informational purposes only. The recipient also agrees to maintain such information and any information made available in connection herewith in strict confidence in accordance with the terms of the OneFund Non-Disclosure Agreement, a copy of which can be viewed here. Neither these materials nor any information contained herein or made available in connection herewith may be copied, published, distributed, transmitted, or otherwise disclosed, wholly or in part, to any third party for any reason whatsoever without the prior written consent of OneFund.

Certain information contained in these materials have been obtained from published and non-published sources prepared by the underlying funds into which OneFund invests as well as by unrelated third parties, which in certain cases have not been updated through the date hereof. While such information is believed to be reliable for the purpose used in these materials, OneFund does not assume any responsibility for the accuracy or completeness of such information and such information has not been independently verified by OneFund. Except where otherwise indicated herein, the information provided in these materials is based on matters as they exist as of the date of preparation of these materials and not as of any future date and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof.

Statements contained in these materials that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of OneFund or the underlying funds into which OneFund invests. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed on such statements. Certain information contained in these materials constitutes “forward-looking statements.” Any forward-looking statement expressing an expectation or belief as to future events is expressed in good faith and believed to be reasonable at the time such forward-looking statement is made. However, these statements are not guarantees of future events and involve risks, uncertainties and other factors beyond OneFund’s control or the control of the funds into which OneFund invests. Therefore, actual outcomes and results may differ materially from what is expressed in any forward-looking statements.

The investments and services offered by OneFund may not be suitable for all investors (i.e., they may not be appropriate for each investor’s goals, needs, and risk tolerance). Investment in private market and alternative investment securities carries specific risks that can impact investment performance, such as, but not limited to, valuation risk, risk associated with the securities of smaller companies (such as bankruptcy), liquidity risk (as most investments will not be traded publicly it may be difficult to liquidate positions early), competitive environment risk due to the number of private equity funds competing for deals, key person risk associated with professionals at certain private equity funds, and market risk. Past performance is no guarantee of future results, and any expected returns or hypothetical projections may not reflect actual future performance. The value of an investment may go down as well as up, and an investor may lose some or all of the money that they invest Nothing in these materials, should be construed as, or is intended to be, an offer to sell or solicitation of an offer to buy any securities, or participate in any investment. If any offer of securities is made, it will be made pursuant to a definitive private placement memorandum and related offering materials (collectively, the “Offering Materials”) prepared by or on behalf of the relevant OneFund fund. Any such Offering Materials would contain material information not otherwise contained herein, which information would supersede the information in these materials. An investment decision should only be made after reviewing the Offering Materials in their entirety, conducting such investigations as the investor deems appropriate and consulting with the investor’s own investment, tax, financial, accounting and legal advisors. No communication by OneFund should be construed as, or is intended to be, investment, tax, financial, accounting, legal, regulatory or compliance advice. OneFund is not a registered investment adviser or registered broker-dealer and does not provide investment recommendations or advice of any kind.

1: Quote and information provided by Animal Capital Fund II LP.

3: Information provided by Breakwater Ventures Fund I LP.

4: Realized gain. Information provided by Breakwater Ventures, LLC.

5: Markups reflect subsequent closed rounds of financing as of January 17, 2022. Calculations only reflect a multiplication of cost by increase in post money valuation markup. Valuations and successive financings are estimations based on unaudited financial and numbers delivered by portfolio management. All information provided by Animal Capital Fund II LP.

6: Unrealized gain. Information provided by Breakwater Ventures, LLC.

7: The information presented in “Highlights across funds” in the Early Stage Venture Portfolio pipeline is derived from information provided to OneFund Investments, LLC (“OF”) by investment managers with historical fund track records (i.e. Animal Capital LLC (“AC”), Breakwater Ventures LLC (“BV”), and Gutter Capital ("GC")). New Lion (a firm previously included in the pipeline) is operating their first fund and is therefore not included and VoLoEarth has not officially published their Fund I performance figures.

“Average Net IRR” represents the average of the internal rates of return (“IRR”) reported by (i) AC’s Animal Capital Fund I LLP (“ACFI”), which was obtained from ACFI’s audited financial statements for the period from March 22, 2021 (inception) to December 31, 2021, and is computed net of management fees and on a hypothetical liquidation basis based in the fair value of ACFI’s assets as of December 31, 2021, and (ii) BV’s SeaChange Fund (“SCF”) I through VI, which was obtained from the presentation of Historical Fund Performance set forth in BV’s Investment Deck and is computed after removing management fees and expected carried interest, and Gutter Capital Fund 0 returns, which was obtained from the presentation of historical fund performance set forth in GC's Investment Deck and is computed by GC after looking at all angel investments made by the GC team through 2017 to 2019 net of hypothetical 2% management fees and 20% carry to simulate fund returns. Note that Fund 0 is modeled on the performance of angel investments made by the Gutter Capital team prior to the inception of Gutter Capital Fund I.

“Multiple on invested capital” or “MOIC” represents the average of MOIC reported by BV’s SeaChange Fund (“SCF”) I through VI, which was obtained from the presentation of Historical Fund Performance set forth in BV’s Investment Deck, and on the net MOIC reported by GC's Gutter Capital Fund 0 set forth in GC's Investment Deck.

“Invested” represents the aggregate capital invested by (i) ACFI, as communicated by AC to OF in October 2022, (ii) SCF I-VII, which was obtained from the presentation of Historical Fund Performance set forth in BV’s Investment Deck, (iii) GC's Fund 0 and Fund I, which was obtained from the GC "Position List, Fund 0" and "Position List, Fund I", and {iv) VoloEarth's Fund I investment figures as of Q3 2022 as reported by VoloEarth in their Investment Deck.

8: “Animal Capital Net IRRs” represents the IRR, rounded to the nearest whole number, reported in ACFI’s audited financial statements for the period from March 22, 2021 (inception) to December 31, 2021 and is computed net of management fees and on a hypothetical liquidation basis based in the fair value of ACFI’s assets as of December 31, 2021.

“Breakwater Ventures Net IRRs” for SCF IV-VII were obtained from the presentation of Historical Fund Performance set forth in BV’s Investment Deck and are computed after removing management fees and expected carried interest.

“Gutter Capital Net IRRs” for GC 0-I were obtained from the Investment Deck shared with OneFund Investments by Gutter Capital and are computed after removing 2% management fees and expected carried interest to simulate fund returns. See footnote 7 for more details on Gutter Fund 0.

9: Represents the average net IRR, rounded to the nearest whole number, across ACFI, SCF IV-VI, and Gutter Capital Fund 0. See footnote 7 for more details on Gutter Fund 0.

10: Information provided by VoLo Earth Ventures Fund II

11: Information provided by Gutter Capital Fund II. Refers to returns of Gutter Fund O, which are the 2017 to 2020 angel investments made by the Gutter Capital General Partners. The top-quartile claims come from the Gutter Fund II overview deck and refer to their track record of angel investments as part of "Gutter 0". Please find more information in the Gutter Fund II Investment Deck.

Note: Updated as of October 2nd, 2023