Last month, J.P. Morgan released their annual long-term capital market outlook for 2023, highlighting their asset return forecasts. In particular, J.P. Morgan called out their belief that “lower valuations and higher yields mean that asset markets today [may] offer the best long-term returns in more than a decade.” Despite the general optimistic tone of the report regarding long-term macroeconomic growth, J.P. Morgan also says that “the worst may not yet be over” with the current sluggish economic environment.

The research can be incredibly useful to investors constructing multi-asset portfolios, but it is LONG at 124 pages. To help, we read the report and highlighted three interesting points regarding private markets below. The full report is also linked in the footnotes if you want to check it out.

First, a potential economic “bumpy road” in the short-term but room for long term optimism

Given the potential for recession, J.P. Morgan expects the streak of sub-trend growth to bleed in to 2023. However, despite this macro and global risk, J.P. Morgan sees these risks as shorter term and “forecast of global trend growth over our 10- to 15-year investment horizon is unchanged at 2.20%.” Additionally, on the inflation front, they raised their “long-term global inflation forecast just 20 basis points, to 2.60%," expecting monetary actions and supply chain solutions to decrease current inflation rates in the years to come.

This is not to say that the next few quarters won’t be messy, by J.P. Morgan believes there is sufficient evidence to indicate that the long term outlook remains positive.

Exhibit 1: J.P. Morgan 2023 Long-Term Capital Market Macroeconomic Assumptions (%, annual average)

Second, Private equity is expected to outperform other alternative asset classes

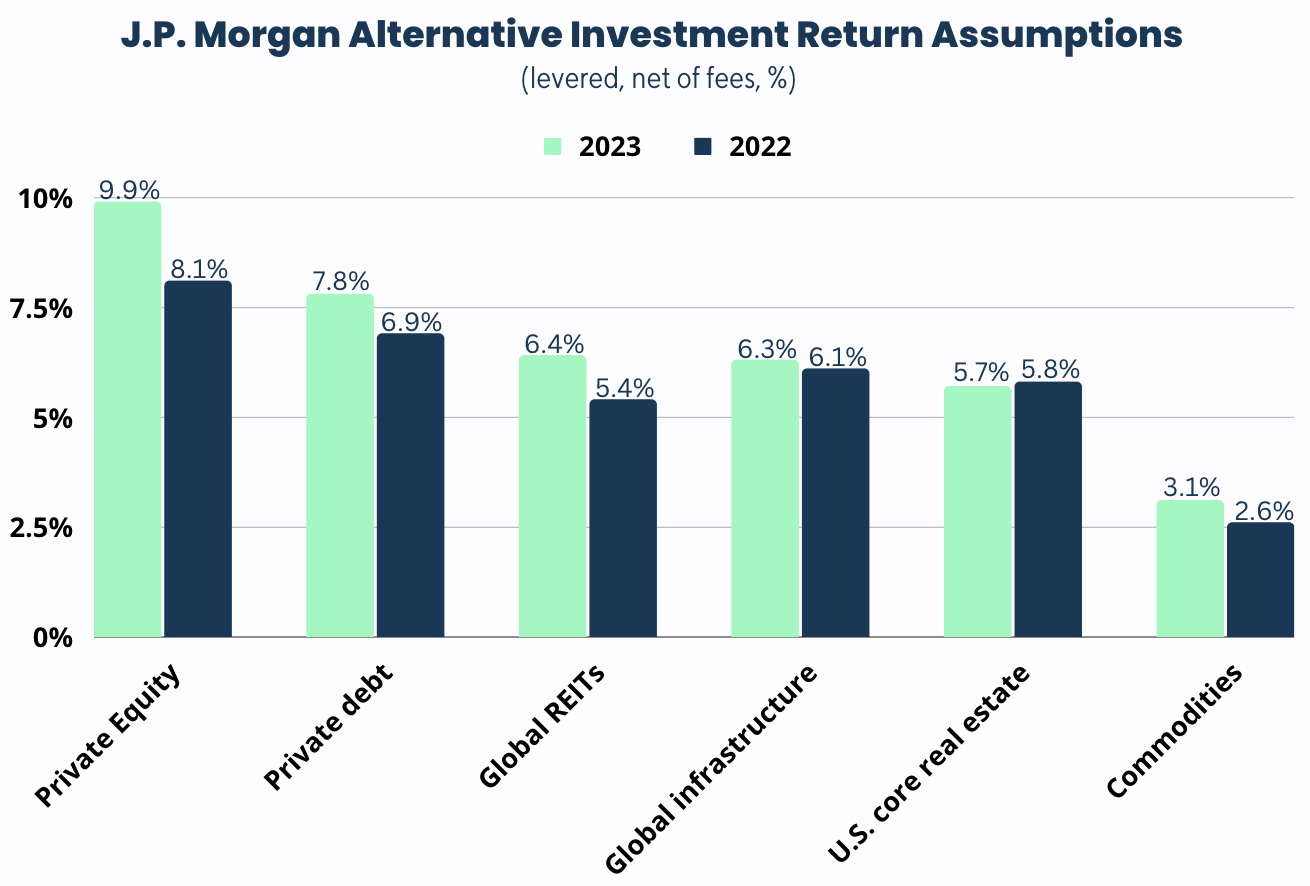

Given J.P. Morgan’s expectation that the long-term economy will perform well, it begs the question which investment classes have the most potential. While the research broadly expects long-term performance to improve across asset classes, it expects Private Equity to have the highest performance of 9.9%, an increase of 180 basis points over the prior year’s estimate. All other asset classes other than Venture Capital were expected to perform under 8%.

Why does J.P. Morgan expect this? For one, “even as return forecasts for public markets roared back this year, alternatives still offer benefits that cannot be easily found elsewhere... alternative assets provided relative safety – for those willing to forgo liquidity, a welcome source of income and strong return uplift. Those attractive qualities endure.” Additionally, while markdowns may exert pressure on Private Equity and Venture Capital returns, the industry has significant dry powder to cushion this and J.P. Morgan explicitly accounted for the risk of markdowns in its projections.

Below is a comparison of J.P. Morgan’s long-term return assumptions across select asset classes in 2023 compared to 2022.

Exhibit 2: J.P. Morgan Long-Term Private Market Return Assumptions by Asset Class

Third, risks from rising interest rates and the highly valued US Dollar

For the first time in a long time, investors are having to contend with non-near zero interest rates. Across the world, interest rates in most currencies are now at or above the cycle-neutral rate. Normalizing rates could have a positive effect on average returns, although high rates still pose challenges.

In addition, the U.S. dollar is highly valued in both nominal and real terms. If values were to fall to historical levels, J.P. Morgan highlights that could lead to a reduction in capital flows towards U.S. assets and urges investors to consider the potential impact of foreign exchange rates on returns.

Join our waitlist and you'll get early access to our beta platform opening up access to top-tier PE & VC funds!

1 Source: J.P. Morgan, 2023 Long-Term Capital Market Assumptions, 2022.