Earlier this year McKinsey & Company released their 2022 Global Private Markets Review. Not too long ago we published our overview on Bain’s 2022 State of Private Equity Report and we found some of the similarities and differences in these reports fascinating. However, McKinsey’s article, like Bain's, is LONG so we’ve shared some key highlights from the report below. You can read the full report via the link in the footnotes if you’re interested.

Strong private equity performance

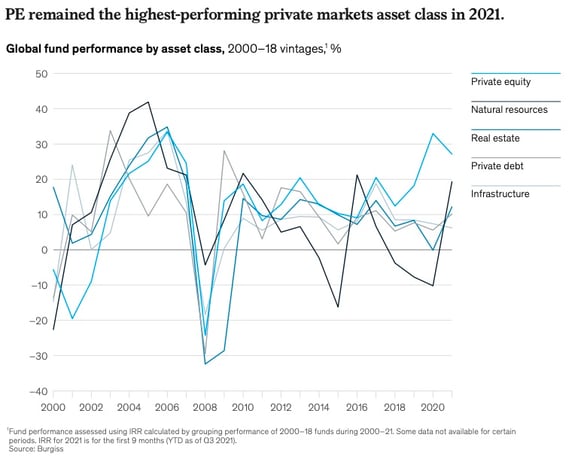

In 2021 PE & VC bounced back strongly from the 2020 pandemic driven dip. In terms of performance, “with a pooled IRR of 27% in 2021, PE was once again the highest performing private markets asset class.” Additionally, “PE also continues to outperform most public market equivalent (PME) measures.” Essentially, not only did PE outperform other private market investments such as real estate, according to McKinsey, but it also outperformed public equities.

Investors should consider new risks when investing in 2022

McKinsey identified that 2022 poses a unique set of risks to investors. Generally, “the Russian government’s invasion of Ukraine, higher inflation and interest rates, and supply chain and labor challenges are already increasing volatility three months into the new year”. More specifically, McKinsey highlighted the transition to sustainability as well. While this transition can create tremendous opportunities for investors and businesses, there are several associated risks such as appropriately assessing novel technologies and investing in new innovative fields. Additionally, as climate has increasing influence on companies, appropriately underwriting climate risk is gaining importance with regard to investment success.

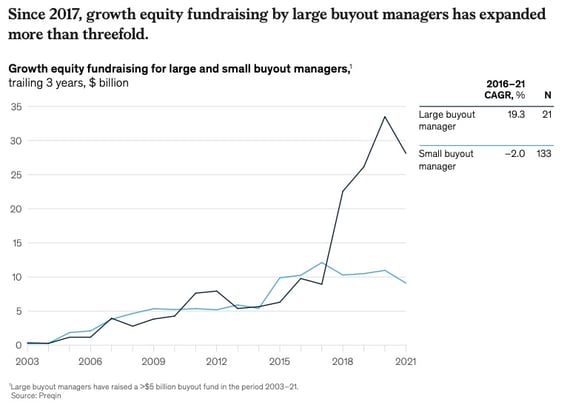

Increasing investments in early-stage funds

Investors continued to pump money into earlier stage funds (i.e., venture capital and more frequently growth equity). McKinsey reported that “venture capital (VC) continued to attract capital on the back of a decade of strong performance but was outpaced by growth equity.” Since many companies are staying private longer and there are a large amount of VC backed companies, it is a target rich environment for growth equity funds. Like Bain’s report which showed many managers were introducing growth equity funds, McKinsey found that 6 of the top 10 largest buyout managers have launched growth vehicles in the last 10 years. In fact, “today, venture capital and growth equity combined make up 47 percent of PE fundraising, just shy of buyout’s share.”

Movements in other sectors of the private markets

Private market investing refers more generally to investing in securities not traded on public exchanges such as the public stock markets (e.g., The New York Stock Exchange, Nasdaq, etc.). While at OneFund we are typically talking about Private Equity, one sub-sector of the private markets (you can read more on the three types of Private Equity here), it’s valuable to keep in mind that there are other areas of private market investing such as real estate, private debt, and infrastructure. McKinsey had the following to say on these areas in their report...

- Real Estate: Investors cycled into higher risk strategies coming out of the pandemic, perhaps anticipating buying opportunities

- Private debt: The private debt markets have continued to grow every year since 2011 in terms of fundraising, showing strong cyclical resilience in part driven by the diversity of private debt strategies

- Infrastructure: Infrastructure broke $1T in global AUM for the first time. It’s no longer just roads and bridges as funds are providing capital for energy and digitization efforts

Join our waitlist and you'll get early access to our beta platform opening up access to top-tier PE & VC funds!

.

1 Source: McKinsey & Company, McKinsey Global Private Markets Review 2022, March 2022.