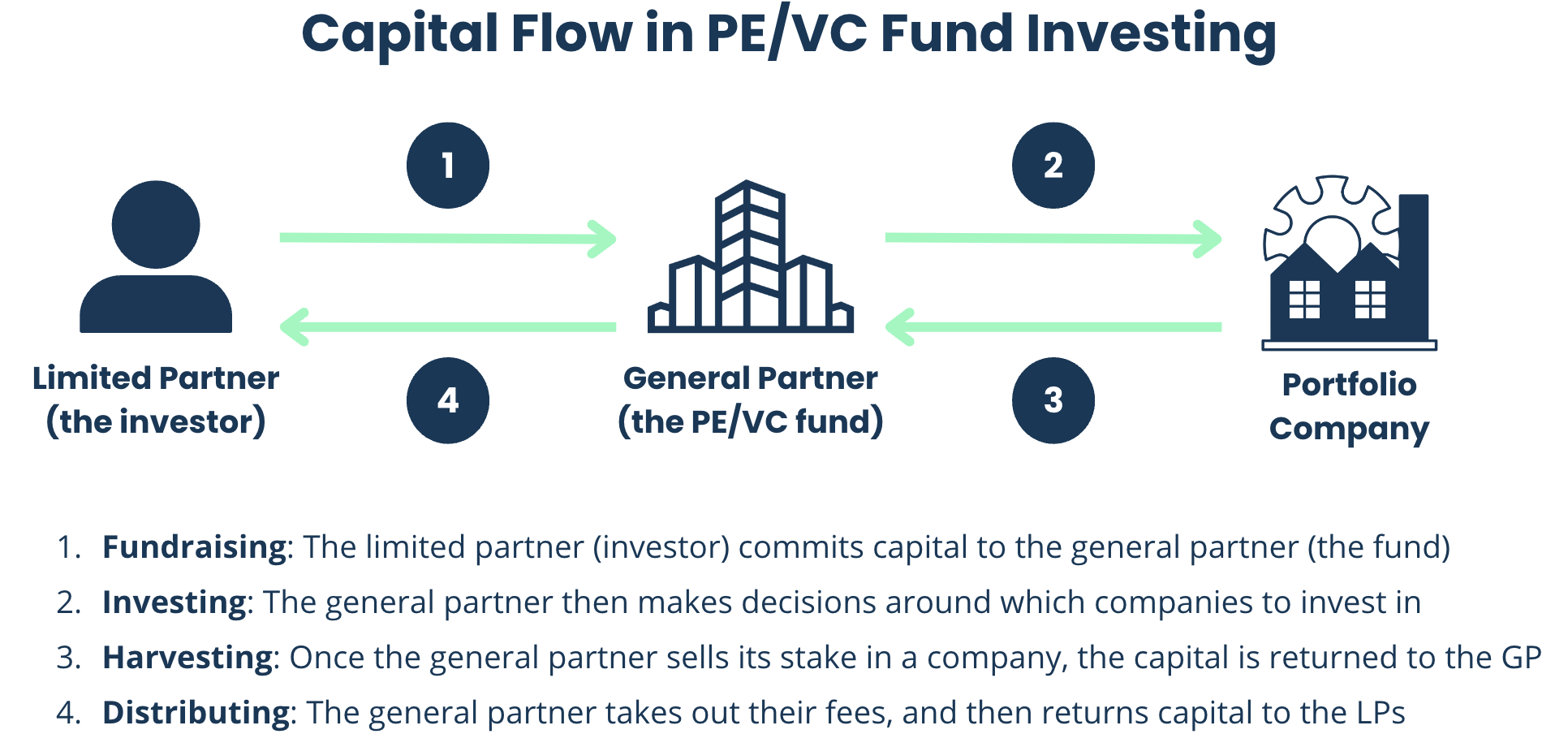

Private equity (PE) and venture capital (VC) funds allow investors to pool their capital to invest in private companies. But, as an investor in a PE or VC fund, what actually happens to your money once you invest? The flow of capital when investing in a PE or VC fund can be confusing, especially for first time investors, and is very different than investing in the stock market. Below is a helpful (and admittedly simplified) overview of how this process works that anyone considering investing in PE/VC funds should be familiar with.

1. Fundraising

Fundraising is what most people think of when they hear someone is "investing in a PE fund". During the fundraising process, a PE/VC fund raises capital from investors, known as limited partners (LPs). Traditionally, LPs are exclusively institutional investors, such as pension funds, endowments, foundations, and high net worth individuals (something at OneFund we're looking to change!). The amount of capital raised determines the size of the fund, and the LPs have a contractual obligation to provide their committed capital to the fund during the fund's "investment period".

2. Investing

Investing in companies is the beating heart of any PE/VC fund's operations. Once the fund has raised capital, the general partner (GP) manages the fund and makes investment decisions on behalf of the LPs. While typically the GP and the PE /VC fund itself are legally distinct entities, for most intents and purposes they can be thought of synonymously. After performing due diligence, if the PE/VC fund decides to invest in a company, the fund will provide capital to the company in exchange for an ownership stake and that company will entire the PE/VC fund's portfolio.

3. Harvesting

After investing, the GP will usually work to improve the portfolio company's operations and financial performance with the goal of growing the company's valuation. It's important to note that the PE/VC fund has sole discretion on when to exit an investment. LPs should especially be aware of this before investing - you don't control when you pull your money out. When the GP determines it is the right time to exit an investment, they will sell their stake in the business. This usually happens through the fund either A) selling their shares to another PE/VC fund, B) selling the whole company to a strategic acquirer (e.g., a large company) or C) taking the company public and selling the shares on the open market.

4. Distributing

After the PE/VC fund has harvested any returns, it will distribute those to the LPs in the fund. Before the PE/VC fund does this however, it will take out its "carried interest" fees. Carried interest is the performance based fees that PE/VC funds charge. These fees both generate revenue for the fund and also keep the fund's interests aligned with those of the limited partners. A common carried interest fee is 20% of returns. Once fees have been paid, the PE/VC fund distributes returns back to the LPs, which is when LPs make their money.

The capital flow in a PE/VC fund is more complicated than that of buying public stocks. There are several active players involved between the original investor (the limited partner), the PE/VC fund itself (the general partner), and the portfolio companies in which the capital is invested. Additionally, while PE and VC fund returns have historically been higher than that of public equities, so are the fees, and you can't sell your position whenever you like - you typically are locked in until the PE/VC fund distributes returns. PE and VC can be a valuable component of a diversified portfolio and understanding how the capital flows work and their timing is important to making an educated decision about investing in a fund.

Want to chat with the OneFund team about due diligence or anything else? Feel free to schedule a call with our founders!