We are increasing access to alternative investments

Join the waitlist for access to our platform and low-minimum investment options.

Claim Your SpotOver the last 25 Years, Private Equity has outperformed public benchmarks by nearly 5 percentage points per year on average.1

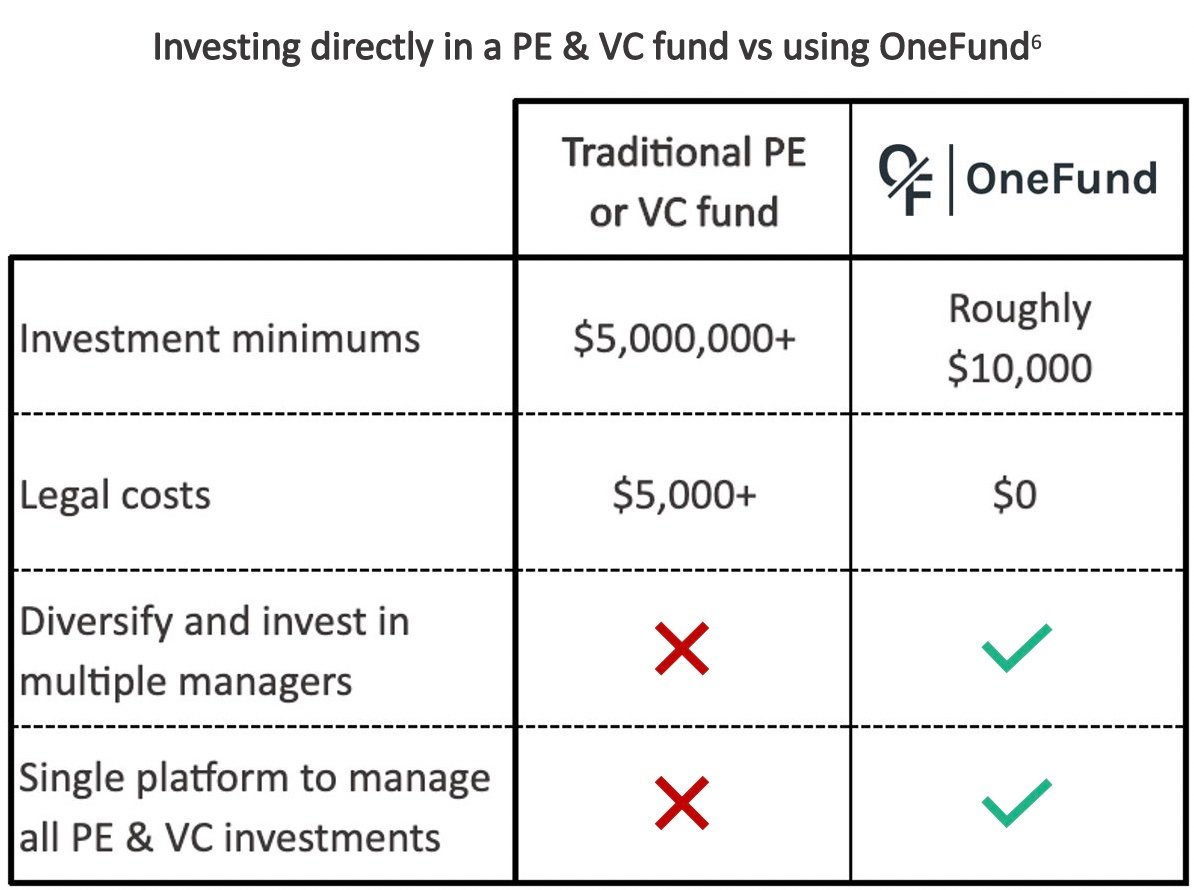

Despite this, access to PE and VC is locked behind high minimum investment requirements, typically in the millions. This means historically only the wealthiest individuals could access private investments. We're changing this.

How It Works

We partner with the world's top PE & VC funds to offer investment options without the million dollar minimums. On our platform investors can decide which of these top funds are right for them and request an allocation.

Members are given access to the platform based on their waitlist position.

1. Sign-up

Create your free account and ensure you are qualified to invest. We handle all the logistics.

2. Analyze funds

View available funds and examine target returns, investment theses, and more to inform your investment. We also offer materials to help think through private market investing. 3

3. Make your investment

Request your investment allocation and finalize the investment.4 Through the portal we will keep you up-to-date on your investments, send tax documents, and distribute returns.

Our Vision

Our goal is to allow everyone to invest in private equity and venture capital, allowing all investors to benefit from their historically high returns, stability, and diversification.5 In the future we plan to expand our offering of alternative investment products to include options such as infrastructure, credit, and hedge funds.

Today, our offerings are limited to accredited investors, however we hope to allow investors of all sizes to participate in the future. You can learn more about this in the FAQs.

See our FAQs

Strategic Partners

Our Story

As former Private Equity, Hedge Fund, and Technology professionals, we've seen the amazing returns that private investing can offer but were dismayed that most investors are locked out of these opportunities.

Discussing this dilemma, we decided there had to be a better way. Thus, OneFund was founded with the mission of opening access to private equity and venture capital.

You can read more of our thoughts in the "News" section.

News